Landlords hit hard in 2016 budget

When the 2016 Budget came out it was clear to see that the chancellor was on the warpath against landlords.

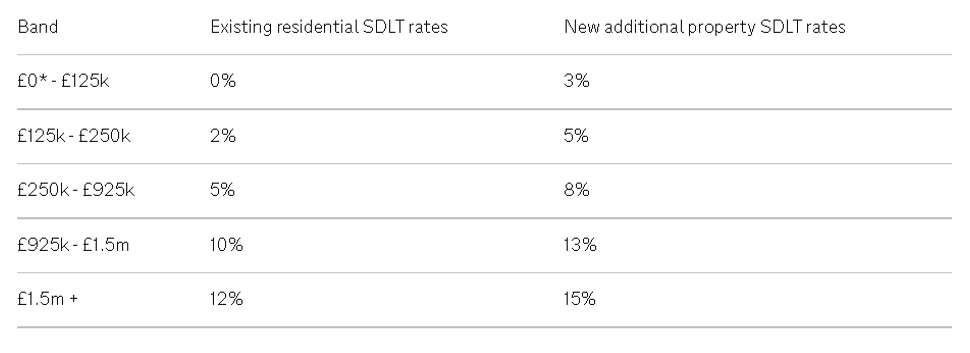

In a two-pronged attack the budget imposes a higher rate of stamp duty on second home owners, as well as limiting tax relief on mortgage interest. As shown in the table below, the new stamp duty rate applies an additional 3% to each band on purchase of a second home. While 3% may not sound like much, this equates to an additional £6,000 on a £200,000 property. Unsurprisingly, this led to a stampede to complete transactions before the new limits came into force with a 77% increase in transactions compared to March 2015.

The second prong of the governments attack, reducing the tax relief on mortgage interest, has gathered far fewer headlines. However, the year on year effects could be more significant considering that a number of landlords fly close to the breakeven point. This is particularly true in the buy-to-let sectors. So what is the restriction? Essentially, over a three year period the amount of mortgage interest that can be set against profits for higher rate (40%) taxpayers will be halved. Basic rate taxpayers will be unaffected, however, most people in a position to invest in multiple properties fall within the higher rate band. Finally, from 2019 landlords must pay capital tax gains due on property sales within 30 days rather than at the end of the year.

The government’s aim with the changes is to promote a cooling of the buy-to-let market. The Bank of England has warned it is concerned over a potential buy-to-let bubble and the government fears buy-to-let is contributing to first time buyers being priced out of the market.

Critics of the measures have voiced concerns that the changes might just lead to an increase in rent and that the measures do not deal with the fundamental issues behind the nation’s housing crisis.