Budget 2016 – Small Business comes out on top

Small Business rates cut!

The big headline announcement in this years budget is the cut to business rates by the extension of the small business rates relief scheme. Currently the scheme means that all properties with a rateable value of < £6,000 don’t pay anything and those < £12,000 get a sliding scale reduction. Under the new scheme, there will be no rates to pay for all property < £12,000, then tapered relief for properties up to £15,000. Furthermore, the threshold for the small business multiplier has been increased from £18,000 to £51,000, which will give a modest saving to larger SMEs.

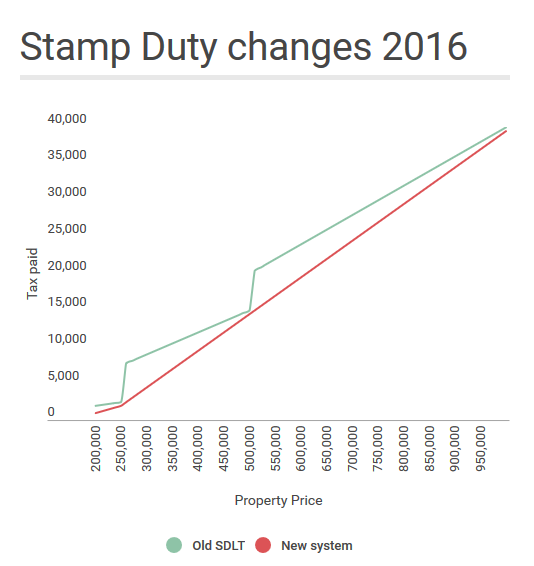

Commercial Stamp duty made fair

Under the previous stamp duty regime, if you purchased a commercial property for £1 over the key thresholds of £250,000 or £500,000 then you paid a higher rate on the entire price. Mr Osbourne has now brought this into line with the residential rates to iron out the massive hikes in tax you can see on the graph below.

To give an example, if you were to purchase a commercial property for £270,000 under the old rules you would pay £8,100 and under the new rules you would pay £3,000.

Corporation tax to reduce 17% by 2020

The government had already announced that Corporation Tax rates would drop to 19% in April 2017 and then 18% in April 2020. This new announcement keeps the 19% reduction planned for 2017, but increases the April 2020 fall to 17%. This increase should be good news for small business owners, as it will help to offset the increased rate of tax on dividends that comes into force this April.

Corporation tax rate

to fall to 19% in April 2017

then 17% in April 2020

Capital Gains Tax cut

Capital Gains Tax has been cut from 28% to 20% for higher rate taxpayers and 18% to 10% for the basic rate. For any property investors, of which there are a great many in the UK with the rapid growth of the buy to let market, there is a very disappointing caveat that, gains on residential property will remain at the old rates. As before, the Principal Private Residence relief that exmpts gains on peoples homes will continue to be in place. The government’s idea with these changes is to create an incentive to invest in companies rather than property.