The buy-to-let market, the bank and the government

Rapid growth of the buy-to-let market

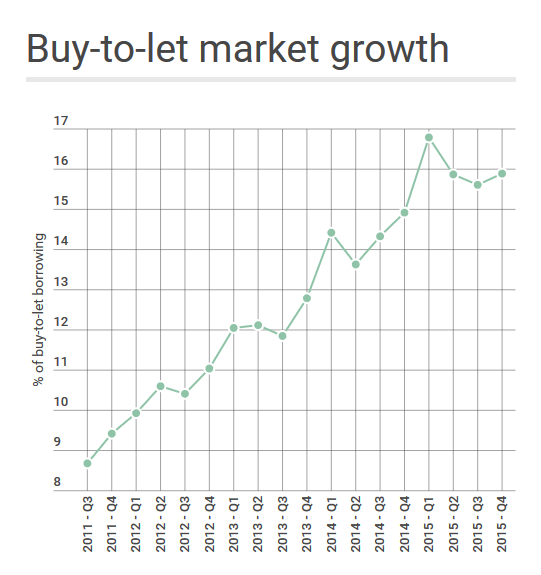

The buy-to-let market has experienced astonishing growth over the past 15 years as people look to capitalise on cheap finance and rising house prices. Add to this stock market volatility and a general distrust of pensions and you have a perfect storm for the market to boom.

In 2000, just 4 % of mortgage lending was for buy-to-let properties. Today this figure is just shy of 16%. The British public has embraced the security of bricks and mortar with many seeing second homes as a pension pot for retirement.

The Bank of England is worried

So why has this got Mike Carney worried? The short answer is financial stability. A longer explanation is that the bank is worried that there are a lot of buy-to-let landlords all just about covering their year on year costs. These landlords are banking on (no pun intended!) the housing market continuing to rise so they can eventually sell at a profit. If, however, there was some form of economic shock, the fear is that all of these landlords could look to sell up en masse. This would create a very painful crash that would be felt across the economy.

So what is the bank doing?

The bank wants to introduce tougher lending controls that strengthen the criteria of buy-to-let mortgages. Currently, if rentals are higher than mortgage repayments potential applicants are a long way down the path to getting a green light on their borrowing. In future, the bank wants all the other costs of owning a property, such as maintenance, to be taken into consideration.

The government has an agenda

The government has introduced tax changes to penalise buy-to-let landlords. Where previously £1,500 stamp duty would have been payable on a £200,000 property, from 1 April people buying a second home will now pay £7,500. Furthermore, a limit on the amount of mortgage interest relief that can be claimed is being introduced.

Why is the government interfering in the buy-to-let market?

The government wants to help first time buyers who are often competing for the same properties as buy-to-let landlords. Currently, high housing prices in some areas are making it impossible for people to afford to buy and an estimated 300,000 people a year, who would otherwise buy, are being forced to rent. The government hopes its tax changes will cool the nations appetite for buy-to-let and help bring the market down.

Will it work?

In all likelihood no. The recent tax changes and the introduction of further controls by the Bank of England may in some areas slow the rate of buy-to-let growth. However, none of the measures will remove the demand that created the buy-to-let explosion in the first place.

Many will also argue that the fundamental problem with the property market is the lack of adequate housing stock and until this is addressed there will be no lasting solution.