Dividend changes from April 2016

Many business owners have heard there is a change coming to dividend tax, but what is the actual impact?

The Autumn Statement produced an unexpected headline for small business owners: the favourable tax situation for dividends is being severely diminished. We explore exactly what difference this will make to business owners and make some practical suggestions on what you can do to ensure an efficient tax position.

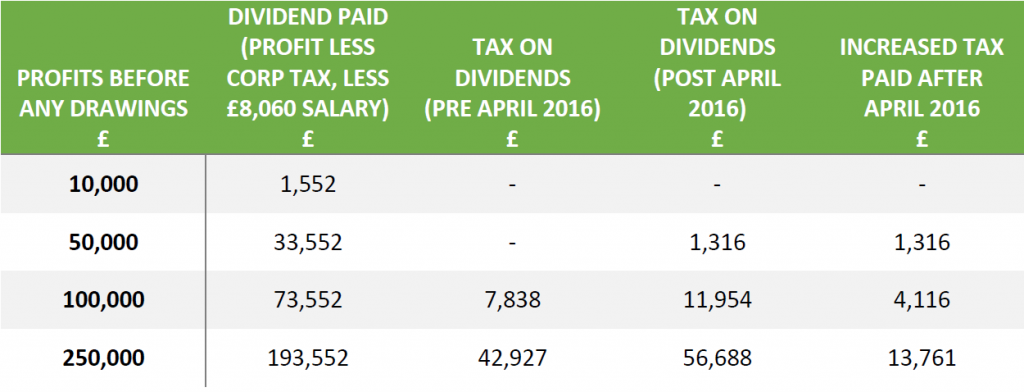

The numbers

For simplicity, the above figures assume a single director, single shareholder company with the company being the only source of income and where all profits are paid out as dividends.

As the table above indicates, the bad news is that under the new regime, it is more than likely that you will pay more tax. However, there are a couple of steps you can take to ensure you are not paying more than you have to.

Pay dividends before 5 April 2016

One obvious suggestion, for the short term at least is to put through a dividend before the rules change, so that you pay tax at the reduced rate. If you normally pay dividends later in the year, it may well be worth you bringing them forwards, or if you have a quarterly dividend scheme, you could consider paying a larger dividend in your first quarter of 2016.

Bring in your spouse

Under the new rules the first £5,000 of dividends received by each individual are tax free. Therefore, in order to make best use of this, it might well be worthwhile you bringing your spouse into the business. Furthermore, the tax rate in the basic rate band on dividends is just 7.5% whereas this rises to 32.5% once you go over £43,000 of income (£11,000 personal allowance and £32,000 basic rate band). Therefore, if you can utilise a partner’s basic rate band a considerable saving could be possible.

Of course it must be said that giving your partner shares changes the ownership of the business and you will need to give this careful consideration.

For further information on the dividend changes and how they will affect your business get in touch with Misty on 01404 41977 or misty@griffinaccountancy.co.uk